Human Resources

Becoming an Employer

As any business grows, it is likely to grow from being just one person to including any number of employees. There might be just one other person, or it could be many more. When it comes time to hire your first employees, it is vitally important to find the right person—but you also must make…

Read This ArticleBusiness Mentoring Series – Building a Culture of Giving with Adam Grant

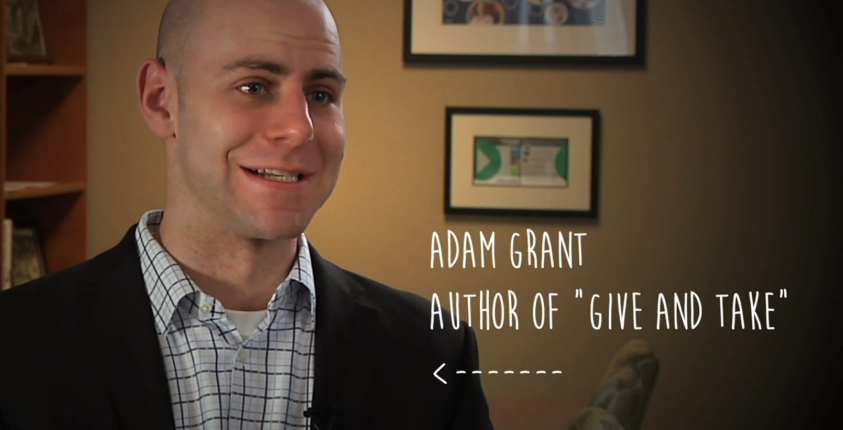

When companies hire Adam Grant to help them, the first question they always want to ask is about hiring. Since so much of his research is about the benefits of giving, how can they build a culture of giving, where people are sharing knowledge, teaching skills, and putting the good of the organization before…

Read This ArticleBusiness Mentoring Series – Give and Take with Adam Grant

Our new Business Mentoring series for May 2014 is Give and Take, featuring Adam Grant, the youngest-tenured and highest-rated professor at The Wharton School of the University of Pennsylvania. Focusing his research on organizational psychology and workplace motivation, he is one of the most acclaimed social science thinkers in the world. He has received awards…

Read This ArticleHiring Lessons from the NFL Combine

The NFL Scouting Combine was held in Indianapolis two weeks ago. All eyes in the football world were on this year’s potential draftees as they ran through a series of tests and drills. But the system is completely flawed. The scouts are timing these players running 40 yard dashes, counting their reps at the bench…

Read This ArticleQuick Read: Social Security and Medicare Taxes Explained

Both the Social Security tax and the Medicare tax consist of two parts — an employee’s portion and an employer’s portion. Employers are required to withhold the employee’s portion of both taxes from the employee’s taxable wages and to pay a matching amount as the employer’s portion. Unless an employer pays employee’s tips, the employer’s…

Read This ArticleA Quick List of Common Types of Insurance Offerings

The article below gives a list of insurance types commonly offered through a business. Employee Term Life Insurance This is the most basic form of life insurance found in American businesses. Employers will either provide at no cost or offer on a payroll deduction basis, group term life insurance in conjunction with the company’s health…

Read This ArticleInsurance Checklist: Deductible vs. Nondeductible

Use this list to determine which types of insurance expenses are deductible for your small business. You can generally deduct premiums you pay for the following kinds of insurance related to your business. Credit insurance on losses from unpaid debts. Fire, theft, flood, or similar insurance. Group hospitalization and medical insurance for employees, including long-term…

Read This ArticleEmployment Taxes

For employment tax purposes, what forms of compensation provided to employees are considered taxable? Basically, taxable compensation for employment taxes is based on an employee’s taxable wages. While not everyone is familiar with the concept of wages for employment tax purposes, federal and state tax laws define wages in very broad terms. Under these laws,…

Read This Article