Posts by Click2Corp

LLC Documentation: Required vs. Needed

In the world of business entities, the Limited Liability Corporation (LLC) is a relative newbie in the United States. Unlike the corporation, which has been around since before the birth of the United States, laws concerning LLCs can still be a bit vague and controversy can arise when legal issues concern the LLC. Due to…

Read This ArticleShould You Form an LLC or a Corporation?

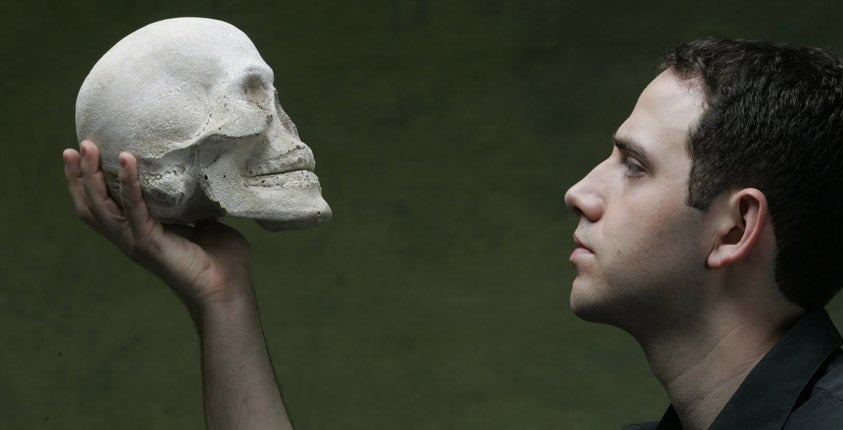

To form an LLC, or a corporation, that is the question. What is the answer, though? Here are some of the differences. Legal Entity vs. Tax Entity Before going any further, let’s make a distinction between a legal entity (LLC v. corporation) and a tax entity (sole proprietor/partnership vs. C-corporation v. S-corporation). Some new entrepreneurs…

Read This ArticleWhen Should You Incorporate?

Just like sports or comedy, when it comes to incorporation, timing is everything. Incorporate too soon, and you may be stuck paying unnecessary fees and taxes, filing unnecessary reports, and just generally wasting your time and money. Incorporate too late and you could face unlimited liability. Here are some factors to consider when timing your…

Read This ArticleHow To Adopt a DBA

Do You Need a DBA? Filing a DBA (“Doing Business As”) is a common step for businesses. Depending on your state, the DBA might also be called a “trade name,” “assumed name,” or “fictitious name.” A DBA allows you to conduct business under a different name for advertising, branding, and other things. The legal name…

Read This ArticleCompliance Requirements: LLC vs. Corporation

Worries over corporate governance are a big reason many people choose not to incorporate and instead settle on another entity type. Corporations have gained a reputation for extremely complicated governance with a lot of rules and regulations, so that corporate directors are spending a lot of time and effort maintaining good standing. Limited Liability Companies,…

Read This Article5 Reasons to Incorporate

One of the most important decisions a business makes is choosing how it is organized. Incorporation may be wise, but for some, it may be unnecessary. Each business should carefully weigh the benefits and drawbacks of incorporation before choosing. Here are 5 reasons incorporation may be a good choice for you. 1. Life A good…

Read This Article10 Reasons Why Businesses Incorporate in Nevada and Delaware

Part of the decision concerning business entity selection, whether you’re forming a corporation or LLC, is choosing your incorporation state. Different states have different costs, tax effects, and laws for corporations. Staying Home or Choosing Another State? Home state incorporation is the choice to incorporate in the state where your business is physically located. You…

Read This ArticleWhat is a Registered Agent?

As you go through the process of incorporating your business, you’ll find many references to registered agents, and will be required to provide information about your registered agent. The registered agent is the person to whom the state goes when it wants to communicate with a corporation or LLC. The registered agent is there to…

Read This ArticleForeign Qualification for Businesses

Just because your company is incorporated in one state doesn’t mean you can’t do business in another. However, in order to do so legally you will have to qualify as a foreign corporation. For example, if you incorporated in your home state, New York, but want to do business in an adjoining state like New…

Read This ArticleBehaving Like a Business Entity

When business owners form a business entity under state law – either a Corporation or a Limited Liability Company – they do so for multiple reasons, the most common of which are: Need for multiple owners in the business Limits on personal liability Tax treatment based on the type of entity selected Simply forming the…

Read This Article